Tactical VS Strategic Investing: Which Approach Is Best For Your Investment Portfolio | INVESTEDMOM

Asset allocation is important for creating an investment portfolio as it ensures lesser risk and higher returns on your investments. However, since different assets have different levels of risks and returns, your investment strategy would be the deciding factor between more or less ROI.

Two common approaches to investing are tactical and strategic, and it’s important you choose the right one for you. Choosing the investment strategy for you would depend on your unique financial goals, risk factors, and investment horizon.

Despite there being many other ways to approach investing, this article will shed light on the two approaches, tactical and strategic asset allocation, to help you build a profitable investment portfolio over time.

What is a Tactical Investment Strategy?

A tactical investment strategy is an active approach to investing. It involves taking advantage of current market conditions and opportunities while adjusting long-term goals according to short-term gains.

For this strategy, rather than buying and holding onto assets, you would allocate your assets based on market timing to gain the highest profit. With tactical asset allocation, you would be able to maximize your portfolio’s profitability at a higher risk.

Example of a Tactical Investment Strategy

A person with an investment portfolio of 50% stocks, 30% cash, and 20% bonds wishes to take a tactical approach to invest. They might notice that the price of bonds has been rising consistently, and after doing some research and talking to their investment portfolio manager, they might change their asset allocation to 60% bonds, 30% stocks, and 10% cash.

This style of investing has a high-risk, high-reward status and is more commonly adopted by people who are well-versed in investing or have a high-risk tolerance.

Advantages of Tactical Investments

Leads to higher short-term gains as market swings are taken advantage of

Adapts to the market by maintaining its ability to remain profitable in negative market conditions

Provides a diversified investment portfolio that leads to higher returns on relatively lower risk

Disadvantages of Tactical investments

Can be challenging as market swings may be difficult to predict or adapt to, and some markets may go up or down longer than expected

Requires extensive knowledge of financial markets and economic activity from the investor

Need to pay higher taxes due to higher levels of short-term capital gain

What is a Strategic Investment Strategy?

A strategic investment strategy is a passive approach to investing where you set long-term goals and achieve them by holding on to allocated assets. In this style of investing the person allocates their assets in real estate, stocks, bonds, and cash with a fixed asset allocation mix and holds on to them until they fulfill the goals of the investor.

The main aim of a strategic investment strategy is to disperse the risk of financial loss rather than profit maximization. Because of this, strategic investments are less vulnerable to market swings and changes in trends - as the investor doesn’t chase short-term gains and instead focuses on long-term objectives.

Example of a Strategic Investment Strategy

A common way of approaching strategic investment is the 60/40 allocation where a person would put 60% of their assets in stocks and 40% in bonds. There are multiple ways you can go about this, as the mix of assets depends on you.

If a person has 60% in stocks and 40% in bonds and they take on a buy-and-hold strategy, they would be unhinged from the rising price of other assets like cash or real estate.

This passive approach to investing has lesser risk, helping you achieve a more stable investment portfolio. However, since you won’t be riding on the trend and doubling down on market opportunities, you might see a lesser return compared to tactical investment strategies.

Advantages of Strategic Investments

Proven strategy with top investors relying on strategic asset allocation including Warren Buffet, Jack Bogle, and Benjamin Graham

It’s less time-consuming and easier to manage as the investor doesn’t need a lot of knowledge beforehand or be very active in the market

Great for long-term capital gains as investments held for over a year are taxed relatively less than short-term gains

Disadvantages of Strategic Investments

Has a higher opportunity cost due to not taking advantage of changing market conditions thus tying up capital

Requires a lot of patience as strategic investments provide long-term gains which may or may not end up in larger profits

May be disrupted due to market crashes which can result in strategic investors to lose most if not all their gains

What is the Difference Between the Strategic VS Tactical Asset Allocation Model?

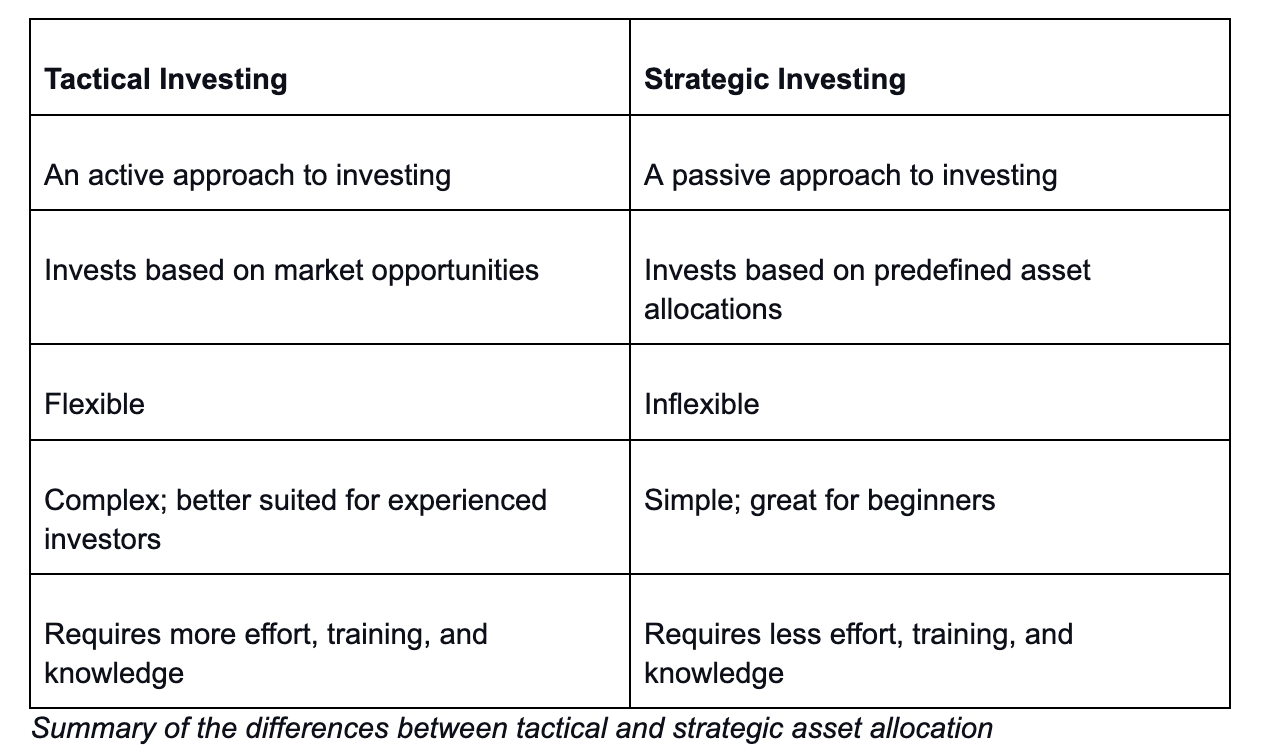

The strategic investment is a passive approach to investing where you would allocate your assets and hold them until you achieve your investment objectives. Tactical investment is an active approach where you evaluate market conditions and trends for asset allocation based on profit maximization and doubling down on opportunities.

The strategic approach to asset allocation has lesser risk as it is inflexible and not heavily influenced by changing market conditions. A tactical asset allocation strategy however has a high-risk, high-reward approach where the investor constantly changes his strategy according to the market conditions and trends.

To decide which investment strategy would be best for you, you would have to consider the following factors:

Your age - Are you close to retirement? If so you might not be able to take as much risk as any financial loss may weigh heavily on you

Your risk tolerance - Are you able to take high levels of risk or do you want to take a more passive approach?

Your knowledge and experience in investing - Do you have a good idea of how to evaluate market trends and make efficient investments?

Your investment horizon - How long are you willing to invest in the market? Are you looking for short-term gains or are you in it for the long run?

Getting answers to the questions above would help you better evaluate your position and know where you stand in the market. It would also help in determining the best possible route for you to start building your investment portfolio.

To make it easier, we discuss who’s better suited for the tactical and strategic investment approach below.

Who Should Use a Tactical Investment Strategy?

Experienced investors who can evaluate market trends and identify opportunities for profit maximization

Investors who wish to maximize their profits, even if it means taking higher levels of risks

People who can take time to trade regularly and find investment opportunities

Investors who want to have a flexible portfolio where they could change asset allocation according to popular market trends

Using a tactical investment strategy requires an in-depth knowledge of financial markets. Investors who rely on a tactical asset allocation approach tend to have the time for daily trading and the knowledge to evaluate, predict, and adapt to market conditions swings, trends, and opportunities.

For newer investors, it’s recommended to take on a more passive approach like strategic asset allocation.

Who Should Use a Strategic Investment Strategy?

Newer investors who are unfamiliar with market conditions and trends and wish to take on a more passive approach

People with a lower risk tolerance or who are closer to retirement so they can disperse the risk with a strategic investment portfolio

Investors who want their portfolio to grow in harmony with the market rather than actively chase market trends and opportunities

Younger individuals with more time to wait and see the gains of their long-term investment strategies and have a diversified portfolio

Having a strategic investment strategy puts you in a place to reach your long-term investment plan goals. Its inflexible, passive approach to investing would provide you with a firm standing and discourage you from making emotional decisions driven by market swings.

Seeing stock market dips and jumps is normal and investors should always be expecting some market volatility. Because of this, having a strategic approach to asset allocation would be a better choice if you’re in it for the long run.

Conclusion

Building an investment portfolio requires having an understanding of your goals, risk factors, and investment horizon. Without these considerations, you risk losing money and seeing low-to-no investment returns.

The two common approaches to investing, tactical and strategic asset allocation, aim to help create a plan to achieve your investment goals.

If you’re new to investing and don’t know where to start, consider speaking to a financial advisor, who can help you set realistic investment goals and determine the best plan of action.

You can start getting educated about investing today by booking a 1-on-1 coaching session with Invested Mom. This can be the first step to getting some clarity on how to get started with investing and creating an investment portfolio your future self will thank you for.

Meet the Author:

Inge was born and raised in Cape Town, South Africa, and moved to Canada in 2010 looking for a better life. She always had an entrepreneurial spirit and started her first side hustle when she was 9 years old – selling fudge at school during lunch breaks.

It wasn’t until much later that she realized that saving isn’t enough to get ahead. She was always very interested in real estate, but saving up for a down payment was grueling and slow, and the demands of life kept getting in the way.

She started investing in herself and upgrading her skills while learning how to invest. She quickly became debt free and compounded her money at a staggering rate.

It wasn’t until she became a coach that she realized how significant an impact she can make in people’s lives by sharing her journey, learnings, and processes.

So here she is, advocating for everyone who is invested and wants to build their wealth, especially the mommas!