7 Best Income Tracking Tools & Techniques for 2024

Are you tired of manually tracking your income and expenses, wondering where your money is going each month? It's time to simplify your financial life with the best income tracking tools and techniques for 2024.

In this article, I'll explore:

Top expense tracking apps like FreshBooks and QuickBooks Online

Discuss the benefits of automation and integration, and

Provide essential tips for accurate expense reporting and tax compliance

Whether you're a small business owner or a freelancer, these tools and techniques will help you take control of your finances and make informed decisions for your future.

Let's dive in and discover how to streamline your income tracking process!

Top Expense Tracking Apps for Small Businesses in 2024

Discover the most efficient expense tracking apps for small businesses

Compare features, pricing, and user experience to find the best fit

Stay on top of your finances and streamline your accounting processes

Looking Ahead: Expense Tracking in 2024

As we enter 2024, small businesses can expect expense tracking apps to continue evolving to meet their changing needs.

Some key developments to watch out for include:

Deeper integration with accounting and invoicing software

Advanced data analytics and predictive insights

Increased focus on data security and privacy

More affordable and scalable pricing models

To stay ahead of the curve, small business owners should:

Regularly assess their expense tracking needs and evaluate new app features

Invest in apps that prioritize data security and compliance

Seek solutions that offer seamless integration with their existing tools and workflows

Leverage expense data to make informed business decisions and optimize costs

By staying informed about the latest trends and choosing the right expense tracking app, small businesses can streamline their financial management and focus on growth in 2024 and beyond.

FreshBooks: Best for Affordability and Efficiency

While both FreshBooks and QuickBooks Online offer robust income tracking solutions, they each have their own strengths and weaknesses. To help you make an informed decision, I've done the hard work of comparing these two popular tools across several key criteria:

Pricing and value for money

Ease of use and setup

Receipt scanning and invoice creation

Time tracking capabilities

Mobile app functionality

Pricing and Value for Money

FreshBooks offers a more affordable pricing structure compared to QuickBooks Online. FreshBooks' Lite plan starts at $17 per month, while QuickBooks Online's Simple Start plan begins at $30 per month. Additionally, FreshBooks provides a 30-day free trial, allowing users to test the software before committing to a subscription.

Ease of Use and Setup

FreshBooks is known for its user-friendly interface and ease of setup. Unlike QuickBooks, which requires an accounting background to fully utilize its features, FreshBooks is designed for both business owners and accountants. This makes it an ideal choice for freelancers and small businesses without extensive accounting knowledge.

Receipt Scanning and Invoice Creation

Both FreshBooks and QuickBooks Online offer receipt scanning and invoice creation capabilities. However, FreshBooks' mobile app allows for seamless receipt scanning and invoicing on the go, making it a more convenient option for freelancers and small business owners who need to manage their finances while away from the office.

Time Tracking Capabilities

FreshBooks includes native time tracking features, allowing users to track time both live and retroactively. This feature is particularly useful for freelancers and small businesses that bill clients based on time worked.

Mobile App Functionality

FreshBooks' mobile app offers a comprehensive set of features, including time tracking, invoicing, and expense management. This makes it an excellent choice for freelancers and small business owners who need to manage their finances while on the move.

By carefully evaluating FreshBooks and QuickBooks Online in each of these areas, you'll gain a clear understanding of which tool best aligns with your specific needs and budget. In the following sections, I'll dive deep into how these two income trackers stack up against each other, assigning a winner for each category. At the end, we'll crown an overall champion based on their cumulative performance.

Whether you prioritize affordability, efficiency, or a balance of both, this comprehensive comparison will empower you to choose the income tracking tool that will help your business thrive in 2024 and beyond. Let's get started by exploring the unique selling points of FreshBooks and QuickBooks Online.

QuickBooks Online: Pricier but Effective

While FreshBooks offers an affordable and efficient solution, QuickBooks Online stands out for its comprehensive features and robust financial management capabilities. Let's explore what sets QuickBooks Online apart and why it might be worth the higher price point for your business.

Judging Criteria

To provide a thorough comparison between FreshBooks and QuickBooks Online, we'll evaluate them based on the following key factors:

Pricing and value for money

QuickBooks Online Plus costs $90 per month, with a promotional offer of $45 per month for the first three months.

Expense and income tracking features

Invoicing and payment acceptance

Financial reporting and forecasting

User experience and ease of use

Customer support and resources

By examining each product through these lenses, we aim to give you a clear understanding of their strengths and weaknesses, empowering you to make an informed decision for your business.

Throughout the rest of this article, we'll dive deep into how FreshBooks and QuickBooks Online perform in each of these areas. We'll assign a winner for each category and, ultimately, determine which tool comes out on top as the best overall choice for income tracking in 2024.

Streamlining Expense Tracking with Automation and Integration

Tracking business expenses is critical for financial health, but it can be time-consuming. Automation and integration features in expense tracking apps help simplify the process.

Benefits of Automating Expense Tracking

Automating expense tracking saves time and reduces errors. It allows you to:

Automatically categorize expenses

Set up rules for recurring expenses

Capture receipts with mobile apps

Sync data across devices and platforms

This means less manual data entry and more accurate records.

Top Expense Tracking Apps with Automation

I tested several expense tracking apps and found these to be the best for automation:

Top Expense Tracking Apps with Automation

Setting Up Integrations for Seamless Management

To get the most out of automation, integrate your expense tracking app with other tools you use, such as:

Accounting software (QuickBooks, Xero)

Payroll systems

CRM platforms

Project management tools

This allows data to flow seamlessly between systems, saving time and ensuring consistency.

Tips for Managing Integrations

Start with the most critical integrations first

Test integrations thoroughly before relying on them

Set up alerts to notify you of sync errors

Regularly review and update integration settings

Automation and Integration: Ramp vs. Competitors

Ramp stands out for its strong automation and integration capabilities compared to other expense tracking tools.

Ramp vs. Competitors

Ramp's AI-driven automation and extensive integration ecosystem make it the clear winner for businesses looking to streamline expense management. Its features go beyond basic automation to provide a truly hands-off experience.

Ramp: Best for Automation and Integration

In our quest to find the best income tracking tools and techniques for 2024, we've taken a deep dive into Ramp and Zoho Expense. To help you make an informed decision, we've broken down our analysis into several key criteria:

Unique Selling Point (USP)

User Experience and Interface

Integrations and Compatibility

Automation and AI Features

Reporting and Forecasting

Pricing and Value

Throughout the rest of this article, we'll explore how Ramp and Zoho Expense stack up in each of these areas. We'll assign a winner for each category and, at the end, determine an overall winner based on their combined performance.

Ramp stands out for its focus on automation and integration. It offers real-time card feeds and automated expense tracking, eliminating the need for manual data entry. This can save businesses countless hours and reduce the risk of errors. Ramp integrates with various accounting software and travel management tools, including direct integration with users' accounting solutions, which helps finance teams save 1-2 days a week tracking expenses, following up with employees, and closing their books.

In addition to streamlining expense tracking, Ramp provides detailed financial reports and forecasts. This can help businesses better understand their cash flow and make informed decisions about budgeting and investments. Ramp offers advanced features such as real-time visibility into spending and automated expense reporting.

Ramp offers a free trial, allowing businesses to test out its features before committing. For larger businesses, custom pricing is available to ensure they get the right plan for their needs. Ramp is 100% free, with no setup fee.

As we continue our comparison, keep these key points about Ramp in mind. In the next section, we'll take a closer look at Zoho Expense and its mobile expense tracking capabilities.

Zoho Expense: Best for Mobile Expense Tracking

When it comes to tracking expenses on the go, Zoho Expense shines. But how does it stack up against Ramp in other areas? To help you make an informed decision, I've evaluated both tools based on the following criteria:

Unique selling points

User experience and interface

Integrations and compatibility

Reporting and analytics

Mobile app functionality

Pricing and value for money

Zoho Expense offers a free plan for up to 3 users, as well as paid options starting at $5 per user per month, making it an affordable choice for businesses of all sizes. Its mobile app allows you to easily track and categorize expenses while you're out and about, ensuring nothing slips through the cracks. The tool integrates seamlessly with Zoho Books and other popular accounting software, streamlining your financial workflow. You can also generate detailed reports and forecasts to gain valuable insights into your company's spending habits.

In the following sections, we'll take a closer look at how Zoho Expense performs in each of the evaluation criteria, so you can determine if it's the right fit for your business needs.

Mastering Expense Categorization for Accurate Tracking

Categorizing expenses is crucial for precise financial reporting and analysis

Common expense categories include travel, office supplies, utilities, and more

Effective categorization systems streamline the tracking process and provide valuable insights

The Importance of Expense Categorization

Accurate expense categorization is essential for businesses to maintain a clear picture of their financial health. By properly organizing expenses into specific categories, companies can easily track where their money is being spent and identify areas for potential cost savings. This level of granularity in expense tracking allows for more informed decision-making and better budgeting practices.

Categorizing expenses also simplifies the process of generating financial reports, such as profit and loss statements and balance sheets. When expenses are properly categorized, it becomes much easier to compile and analyze financial data, leading to more accurate and timely reporting. This, in turn, helps businesses make data-driven decisions and communicate their financial performance to stakeholders and investors.

Common Expense Categories

While expense categories may vary depending on the nature of the business, there are several common categories that most companies use:

Travel: This category includes expenses related to business trips, such as airfare, lodging, transportation, and meals.

Office Supplies: Expenses for items like stationery, printer ink, paper, and other consumables fall under this category.

Utilities: This category encompasses expenses for electricity, water, gas, and internet services.

Rent and Lease: Expenses related to office space, warehouses, and other business facilities are included here.

Salaries and Wages: This category covers the compensation paid to employees, including salaries, bonuses, and commissions.

Marketing and Advertising: Expenses for promoting the business, such as social media ads, print materials, and event sponsorships, fall under this category.

Professional Services: This category includes expenses for services provided by external consultants, lawyers, accountants, and other professionals.

By using these standard categories, businesses can ensure consistency in their expense tracking and facilitate benchmarking against industry norms.

Creating and Maintaining an Effective Categorization System

To create an effective expense categorization system, businesses should follow these tips:

Define clear categories: Establish well-defined expense categories that align with the company's financial reporting requirements and operational needs.

Use subcategories: Break down main categories into subcategories for more detailed tracking. For example, the "Travel" category could include subcategories like "Airfare," "Lodging," and "Meals".

Implement consistent naming conventions: Ensure that all employees use the same category names and definitions to maintain consistency and avoid confusion.

Regularly review and update categories: As the business evolves, periodically review the categorization system to ensure it remains relevant and effective.

Leverage technology: Utilize expense tracking software that allows for easy categorization and automation of the process, reducing manual effort and minimizing errors.

By implementing these best practices, businesses can create and maintain an effective expense categorization system that supports accurate financial tracking and reporting.

Further Reading and Resources

To dive deeper into the topic of expense categorization and its role in financial management, consider exploring these resources:

"Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really Mean" by Karen Berman and Joe Knight - This book provides a comprehensive overview of financial concepts, including expense categorization, for non-financial managers.

"QuickBooks Online for Dummies" by David H. Ringstrom - For businesses using QuickBooks for their accounting needs, this guide offers practical advice on setting up and managing expense categories within the software.

"The Ultimate Guide to Expense Categories" by Fyle - This blog post provides a detailed breakdown of common expense categories and offers tips for creating a well-structured categorization system.

By mastering expense categorization, businesses can gain a clearer understanding of their financial performance, make informed decisions, and ultimately drive growth and profitability.

The Importance of Expense Categorization

TL;DR:

Categorizing expenses is crucial for effective budgeting and financial planning

It simplifies tax compliance and helps with reimbursement processes

Breaking down broad categories into specific ones provides better insights

Effective Budgeting and Financial Planning

Categorizing expenses is a fundamental aspect of effective budgeting and financial planning. By organizing expenses into specific categories, individuals and businesses can gain a clearer understanding of where their money is being spent. This information is invaluable when it comes to setting financial goals, creating budgets, and making informed decisions about future spending.

When expenses are properly categorized, it becomes easier to identify areas where spending may be excessive or unnecessary. For example, if a business notices that a significant portion of its expenses falls under the category of "office supplies," it may prompt a closer examination of those purchases. This could lead to the discovery of opportunities to cut costs, such as finding alternative suppliers or eliminating redundant purchases.

Categorizing expenses allows for the creation of more accurate and realistic budgets. By analyzing historical spending data across various categories, businesses can make informed projections about future expenses. This enables them to allocate resources more effectively and plan for potential financial challenges.

Simplified Tax Compliance and Reimbursement Processes

Expense categorization plays a crucial role in simplifying tax compliance and reimbursement processes. When expenses are properly categorized, it becomes much easier to identify which expenses are tax-deductible and which are not. This is particularly important for businesses, as claiming appropriate deductions can significantly reduce their tax liability.

According to the IRS, common tax-deductible business expenses include:

Business use of your car

Employee wages

Rent and utilities for business property

Business insurance

Advertising and promotion costs

By categorizing expenses according to these guidelines, businesses can ensure that they are claiming all eligible deductions and minimizing their tax burden.

In addition to tax compliance, expense categorization streamlines the reimbursement process. When employees submit expense reports, having expenses already categorized makes it easier for managers or accounting departments to review and approve those reports. This not only saves time but also reduces the likelihood of errors or disputes.

Breaking Down Broad Categories

While broad expense categories like "supplies" or "travel" can be useful, breaking them down into more specific subcategories provides even greater insights and control over spending.

As an example, instead of lumping all travel expenses together, a business might create subcategories such as:

Airfare

Lodging

Ground transportation

Meals and entertainment

By doing so, the business can more easily identify which aspects of travel are consuming the most resources. This information can be used to negotiate better rates with vendors, establish per diem allowances, or even reevaluate the necessity of certain trips.

Case Study: Leveraging Expense Categorization for Cost Savings

A real-world example of effective expense categorization can be seen in the case of a global retail chain. The company implemented AI-powered spend analysis to optimize its procurement processes. By automating data entry, categorization, and analysis, the company reduced its procurement cycle times by 30%. Additionally, AI-driven predictive analytics helped the organization identify cost-saving opportunities, resulting in a 15% reduction in annual procurement costs.

This example illustrates how categorizing expenses and leveraging advanced tools can lead to significant cost savings and improved financial management. By breaking down expenses into detailed categories and analyzing spending patterns, businesses can identify inefficiencies and implement targeted strategies to optimize their expenditures.

Customizing Expense Categories

While there are many standard expense categories that apply to most businesses, it's important to recognize that every organization is unique. Therefore, customizing expense categories to fit the specific needs and structure of your business is essential.

For example, a construction company might require categories like "raw materials," "equipment rental," and "subcontractor fees," while a software development firm might need categories for "cloud hosting," "developer tools," and "user testing."

By tailoring expense categories to your business, you can ensure that you're capturing all relevant costs and gaining the most meaningful insights from your financial data.

Further Reading

For more information on customizing expense categories and optimizing your financial tracking, consider these resources:

"Profit First: Transform Your Business from a Cash-Eating Monster to a Money-Making Machine" by Mike Michalowicz

"The Tax and Legal Playbook: Game-Changing Solutions to Your Small Business Questions" by Mark J. Kohler

"QuickBooks for Dummies" by Stephen L. Nelson

These books provide valuable guidance on structuring your financial systems, maximizing tax deductions, and using popular accounting software to streamline your expense tracking processes.

Customizing Expense Categories for Your Unique Situation

Tailor expense categories to your business for accurate financial tracking

Examples of industry-specific expense categorization for clarity

Consistently categorize expenses for reliable financial insights

Creating Custom Expense Categories for Your Business

Every business has unique financial needs, and generic expense categories may not always provide the level of detail necessary for accurate tracking and reporting. By creating custom expense categories tailored to your specific industry or business model, you can gain better insights into your financial health and make more informed decisions.

Identifying Your Business's Unique Expenses

To create custom expense categories, start by examining your business's unique expenses. Consider the types of costs that are specific to your industry or operations. For example, a construction company may have expenses related to raw materials, equipment rental, and subcontractor fees, while a software development firm might have expenses for cloud hosting, software licenses, and employee training.

Examples of Industry-Specific Expense Categorization

To help you understand how to customize expense categories for your business, let's look at a few examples from different industries:

Restaurant Expense Categories

Food and beverage costs

Kitchen supplies and equipment

Front-of-house supplies (e.g., linens, tableware)

Delivery and catering expenses

Licenses and permits

E-commerce Expense Categories

Inventory and product costs

Shipping and handling fees

Payment processing fees

Website hosting and maintenance

Marketing and advertising expenses

Healthcare Expense Categories

Medical supplies and equipment

Staffing and training costs

Insurance and regulatory fees

Patient care and services

Administrative expenses

Manufacturing Expense Categories

Raw materials and inventory costs

Equipment maintenance and replacement

Labor and production costs

Quality control and testing expenses

Packaging and shipping costs

The Importance of Consistent Expense Categorization

Once you've established custom expense categories for your business, it's crucial to maintain consistency in how you categorize expenses. Inconsistent categorization can lead to inaccurate financial reports, making it difficult to track your business's performance over time. According to a study by the Institute of Internal Auditors, inconsistent expense categorization can result in a 10% to 20% error rate in financial reporting.

To ensure consistency:

Create a clear set of guidelines for categorizing expenses

Train all employees involved in expense reporting on these guidelines

Regularly review and update your expense categories as your business evolves

Implementing Expense Categorization Best Practices

To further improve your expense categorization process, consider the following best practices:

Use descriptive category names that clearly identify the type of expense

Avoid creating too many categories, as this can lead to confusion and inconsistency

Regularly review your expense data to identify any miscategorized expenses

Leverage technology, such as expense tracking software, to automate categorization and reduce human error

By customizing your expense categories to reflect your business's unique needs and consistently applying these categories, you'll be able to gain valuable insights into your financial performance and make data-driven decisions to support your growth.

Essential Tips for Accurate Expense Reporting and Tax Compliance

Ensure accurate expense reporting to avoid tax penalties and audits

Stay organized throughout the year to simplify tax filing

Know which documents are required for expense reporting

Accurate expense reporting is crucial for maintaining tax compliance and avoiding potential penalties or audits. By diligently tracking and categorizing your expenses, you can ensure that your business is prepared for tax season and can claim all eligible deductions.

The Importance of Accurate Expense Reporting

Inaccurate expense reporting can lead to serious consequences, including:

Underpayment of taxes, resulting in penalties and interest

Overpayment of taxes, leading to a loss of funds that could have been invested back into your business

Increased risk of an audit by tax authorities

Consequences of Inaccurate Reporting

Tax penalties for inaccurate reporting can be severe. Depending on the severity and frequency of the errors, businesses may face:

Monetary fines

Interest on underpaid taxes

Legal action in extreme cases

Accurate expense reporting not only helps you avoid these consequences but also ensures that you claim all eligible deductions, thereby minimizing your tax liability.

Staying Organized Throughout the Year

One of the keys to accurate expense reporting is staying organized throughout the year. This means:

Consistently tracking expenses as they occur

Categorizing expenses according to your customized expense categories

Storing receipts and invoices in a secure, easily accessible location

Implement a System for Tracking Expenses

Establish a system for tracking expenses that works for your business. This may involve:

Using expense tracking software

Maintaining a spreadsheet

Keeping a physical folder for receipts and invoices

The key is to choose a method that you can maintain consistently and that allows you to easily retrieve information when needed.

Set Aside Time for Regular Expense Review

Regularly review your expenses to ensure accuracy and completeness. This may involve:

Reconciling expenses with bank and credit card statements

Verifying that expenses are categorized correctly

Identifying any missing receipts or documentation

By setting aside dedicated time for expense review, you can catch errors early and avoid a scramble come tax season.

Checklist of Documents Needed for Expense Reporting

To ensure accurate expense reporting, keep the following documents on hand:

Receipts for all business purchases

Invoices from vendors and contractors

Bank and credit card statements

Mileage logs for business travel

Home office expenses (if applicable)

By maintaining these documents throughout the year, you'll be well-prepared for tax filing and able to support your expense claims in the event of an audit.

Understanding the Importance of Expense Reporting

Accurate expense reporting is essential for tax compliance and financial planning

Inaccurate or incomplete expense reporting can lead to costly consequences

Maintaining accurate expense records requires diligence and attention to detail

The Impact of Accurate Expense Reporting on Tax Compliance

Accurate expense reporting is crucial for businesses to remain compliant with tax regulations. The Internal Revenue Service (IRS) requires companies to maintain detailed records of all business expenses, including receipts, invoices, and other supporting documentation. Failure to comply with these requirements can result in audits, penalties, and even legal action.

Accurate expense reporting helps businesses claim the correct deductions on their tax returns. By carefully tracking and categorizing expenses, companies can maximize their deductions and reduce their overall tax liability. This can result in significant savings, especially for small businesses with tight profit margins.

The Consequences of Inaccurate Expense Reporting

Inaccurate or incomplete expense reporting can have severe consequences for businesses. The IRS may audit companies that fail to maintain proper records or claim suspicious deductions. If discrepancies are found, businesses may face penalties, interest charges, and back taxes. In extreme cases, criminal charges may be filed for tax evasion.

Beyond the legal ramifications, inaccurate expense reporting can also lead to financial planning issues. Without a clear picture of expenses, businesses may struggle to create accurate budgets, forecast cash flow, or make informed decisions about investments and growth opportunities. This can hinder a company's ability to compete in the marketplace and achieve long-term success.

Inaccurate Expense Reporting Penalty

Inaccurate Expense Reporting: Offense and Penalty

Best Practices for Maintaining Accurate Expense Records

To avoid the consequences of inaccurate expense reporting, businesses must develop a system for tracking and documenting expenses. This may involve using accounting software, mobile apps, or even simple spreadsheets. The key is to establish a consistent process and stick to it.

Some best practices for maintaining accurate expense records include:

Keeping receipts and invoices for all business expenses

Categorizing expenses based on IRS guidelines

Recording expenses promptly to avoid forgetting or losing documentation

Reviewing expense reports regularly to catch errors or discrepancies

Utilizing technology to automate expense tracking and reporting

By following these best practices, businesses can ensure they are always prepared for tax season and avoid costly mistakes.

Recommended Resources for Further Learning

For businesses looking to dive deeper into the topic of expense reporting and tax compliance, several resources are available:

"Deduct It!: Lower Your Small Business Taxes" by Stephen Fishman (book)

"475 Tax Deductions for Businesses and Self-Employed Individuals" by Bernard B. Kamoroff (book)

"Small Business Taxes for Dummies" by Eric Tyson (book)

IRS Publication 535, "Business Expenses" (government resource)

SCORE.org: "A Guide to the Schedule C" (online article)

By investing time in understanding the importance of accurate expense reporting and developing a robust system for tracking expenses, businesses can position themselves for long-term financial success and avoid costly legal issues.

Keeping Track of Expenses for Small Businesses

Discover effective strategies to overcome the unique expense tracking challenges faced by small businesses

Learn how to properly separate personal and business expenses for accurate financial records

Explore top-rated tools and software designed specifically for small business expense tracking

Overcoming Unique Expense Tracking Challenges for Small Businesses

Small businesses often face distinct challenges when it comes to tracking expenses accurately. Unlike larger corporations with dedicated accounting departments, small business owners frequently juggle multiple roles, leaving less time for meticulous record-keeping. Mark Kohler, CPA and author of "The Tax and Legal Playbook," emphasizes the importance of establishing a clear system from the start:

"Small business owners need to set up a separate business bank account and credit card to ensure a clear separation between personal and business expenses".

Another common hurdle is the temptation to mix personal and business expenses, especially for sole proprietors and home-based businesses. Donna Fuscaldo, business finance expert at Business News Daily advises,

"It's crucial to maintain separate records and receipts for all business-related purchases, no matter how small."

Failing to do this can lead to inaccurate financial statements and potential tax implications.

Separating Personal and Business Expenses

Maintaining a clear separation between personal and business expenses is essential for small businesses. Comingling funds can lead to confusion, inaccurate financial reporting, and potential legal issues.

Caron Beesley, contributor to the U.S. Small Business Administration blog recommends,

"Open a separate business bank account and obtain a business credit card to ensure a clear divide between personal and business transactions."

Tips for Separating Expenses

Use a dedicated business credit card for all business-related purchases

Maintain separate receipts and records for business transactions

Regularly categorize and record expenses in accounting software

Establish clear policies for employee expense reimbursements

Conduct periodic audits to identify and correct any discrepancies

Beesley notes,

"By implementing these best practices, small business owners can minimize the risk of financial confusion and ensure accurate expense tracking."

Top Tools and Software for Small Business Expense Tracking

Leveraging technology can significantly streamline expense tracking processes for small businesses. Yoseph West, CEO of Relay Financial, suggests,

"Invest in a user-friendly accounting software that integrates with your business bank account and credit card for automatic expense categorization and real-time financial insights".

Popular expense tracking tools for small businesses include:

QuickBooks: Offers powerful expense tracking, invoicing, and financial reporting features

Xero: Cloud-based accounting software with robust expense management capabilities

FreshBooks: User-friendly interface and mobile app for on-the-go expense tracking

Expensify: Automates expense report creation and streamlines reimbursement processes

Wave: Free accounting and expense tracking software for small businesses

West adds,

"By using these tools, small business owners can save time, reduce manual data entry, and gain valuable insights into their financial performance,"

Comparison of Expense Tracking Tools

Expense Tracking Tools Key Features and Pricing

Accurate expense tracking is crucial for small businesses to maintain financial transparency and make informed decisions. By implementing effective strategies, separating personal and business expenses, and leveraging technology, small business owners can streamline their expense tracking processes and ensure financial success.

Leveraging Technology for Effortless Expense Tracking

Discover the power of technology in simplifying expense tracking for small businesses

Explore the best apps, software, and online tools for accurate financial management

Learn how to choose the right technology based on your unique business needs

As a small business owner, staying on top of expenses is crucial for financial stability and growth. Fortunately, modern technology offers a range of solutions to streamline the expense tracking process, saving time and reducing the risk of errors. By leveraging the right tools, you can focus on what matters most: running your business.

The Benefits of Using Technology for Expense Tracking

Technology has revolutionized the way small businesses manage their finances, particularly when it comes to expense tracking. By automating the process, you can ensure greater accuracy and efficiency, while also freeing up valuable time and resources.

According to a survey by the National Small Business Association, 27% of small business owners report spending more than 5 hours per month on accounting tasks, including expense tracking. However, by implementing the right technology, this time can be significantly reduced.

Automation: The Key to Efficiency

One of the primary benefits of using technology for expense tracking is automation. By connecting your business bank accounts and credit cards to your accounting software, transactions can be automatically categorized and recorded, eliminating the need for manual data entry.

As Jared Weitz, CEO and Founder of United Capital Source Inc., explains,

"Automation is the future of small business accounting. By leveraging technology to handle routine tasks like expense tracking, business owners can focus on growth and innovation."

Improved Accuracy and Reduced Errors

Manual expense tracking is prone to errors, which can lead to inaccurate financial reporting and potentially costly mistakes. By using technology to automate the process, you can significantly reduce the risk of human error and ensure that your financial data is accurate and up-to-date.

"Accurate expense tracking is the foundation of sound financial management. Technology not only helps reduce errors but also provides real-time insights into a business's financial health."

Types of Technology Available for Expense Tracking

There are several types of technology available to help small businesses streamline their expense tracking processes. These include:

Accounting Software: Comprehensive solutions like QuickBooks, Xero, and FreshBooks offer features specifically designed for expense tracking, including automatic categorization and real-time reporting.

Mobile Apps: For businesses on the go, mobile apps like Expensify, Zoho Expense, and Shoeboxed allow users to capture receipts, track mileage, and submit expense reports from their smartphones.

Online Tools: Cloud-based tools like Concur, Fyle, and Expensify offer seamless integration with existing accounting software, making it easy to manage expenses from anywhere with an internet connection.

As Sarah Johnson, a small business owner, shares her experience, "Switching to a cloud-based expense tracking system was a game-changer for my business. I can now manage my expenses from anywhere, and the automatic sync with my accounting software saves me hours each month."

Choosing the Right Technology for Your Business

With so many options available, choosing the right expense tracking technology for your small business can seem overwhelming. Consider the following factors when making your decision:

Integration: Look for solutions that seamlessly integrate with your existing accounting software and business tools.

Scalability: Choose a system that can grow with your business, offering features and pricing plans that accommodate your changing needs.

User-Friendliness: Ensure that the technology you choose is easy to use and navigate, with a minimal learning curve for you and your team.

As Mark Thompson, a small business consultant, advises,

"When selecting expense tracking technology, prioritize solutions that align with your business's unique needs and goals. Don't get caught up in flashy features; instead, focus on tools that will save you time and money in the long run."

By leveraging the power of technology for expense tracking, small business owners can streamline their financial management processes, reduce errors, and gain valuable insights into their company's financial health. With the right tools in place, you can focus on what matters most: growing your business and achieving your goals.

Automating Expense Tracking with Card Feeds

Card feeds make expense tracking effortless by automatically importing transactions

Popular apps like QuickBooks and Xero support card feeds for seamless integration

Bank-level encryption and secure data transmission ensure financial data safety

What Are Card Feeds and How Do They Work?

Card feeds are a powerful tool that automate the process of importing credit card and bank transactions into your accounting or expense tracking software. Instead of manually entering each transaction, card feeds securely connect to your financial institutions and pull in the relevant data automatically on a regular basis, often daily.

When you set up a card feed, you provide your accounting software with the necessary login credentials and permissions to access your credit card or bank account. The software then establishes a secure connection using bank-level encryption to protect your sensitive financial information. On a scheduled basis, typically every 24 hours, the software automatically imports new transactions, saving you time and reducing the risk of manual entry errors.

Benefits of Using Card Feeds for Expense Tracking

Implementing card feeds for expense tracking offers several significant advantages for businesses and individuals alike:

Time Savings and Efficiency

By automating the transaction import process, card feeds eliminate the need for manual data entry. This saves valuable time that can be better spent on more strategic tasks, such as analyzing spending patterns or identifying cost-saving opportunities. With card feeds, you can ensure that your expense records are always up to date without dedicating hours to data entry.

Improved Accuracy and Fewer Errors

Manual data entry is prone to human error, which can lead to inaccurate expense reports and financial statements. Card feeds minimize the risk of errors by automatically importing transactions directly from the source. This improved accuracy helps maintain the integrity of your financial data and enables better decision-making based on reliable information.

Popular Apps and Services Supporting Card Feeds

Many leading accounting and expense tracking apps and services have embraced card feeds to streamline the expense management process for their users. Some popular options include:

QuickBooks: QuickBooks Online supports card feeds from a wide range of financial institutions, making it easy to automate expense tracking for small businesses and freelancers.

Xero: Xero, a cloud-based accounting software, offers card feed integration with major banks and credit card providers, enabling seamless transaction import and reconciliation.

FreshBooks: FreshBooks, a popular choice for small businesses and solopreneurs, allows users to connect their bank accounts and credit cards for automatic expense tracking.

Expensify: Expensify is a dedicated expense management app that supports card feeds to simplify the expense reporting process for employees and businesses.

Comparison Table of Popular Apps and Services Supporting Card Feeds:

Popular Apps and Services Supporting Card Feeds

Security Measures Protecting Financial Data

When dealing with sensitive financial information, security is of utmost importance. Apps and services that offer card feeds implement robust security measures to protect user data:

Bank-Level Encryption: Card feed connections use bank-level encryption, such as 256-bit SSL/TLS, to ensure that data transmitted between the financial institution and the accounting software is secure and protected from unauthorized access.

Secure Data Storage: Reputable apps and services employ secure data storage practices, including encryption at rest, to safeguard financial information stored on their servers.

Regular Security Audits: Many providers conduct regular security audits and assessments to identify and address potential vulnerabilities, ensuring the ongoing protection of user data.

User Authentication and Access Controls: Strict user authentication measures, such as two-factor authentication and role-based access controls, help prevent unauthorized access to financial data within the expense tracking software.

By prioritizing security, these apps and services provide peace of mind to users who entrust them with their financial data.

Integrating Expense Tracking with Other Financial Tools

Streamline your financial management by connecting expense tracking tools with accounting software and budgeting apps

Popular financial tools like QuickBooks, Xero, and YNAB offer seamless integration with expense tracking apps

Proper setup and management of integrations lead to more accurate financial data and time savings

The Benefits of Integrating Expense Tracking with Other Financial Tools

Integrating expense tracking tools with other financial software, such as accounting systems and budgeting apps, can significantly enhance your overall financial management process. By connecting these tools, you can:

Reduce manual data entry: When expense tracking apps are integrated with accounting software, transactions are automatically synced, eliminating the need for manual data entry and reducing the risk of errors.

Gain real-time insights: Integrations allow you to have a up-to-date view of your financial situation, enabling you to make informed decisions based on accurate, real-time data.

Save time: Automating data flow between expense tracking and other financial tools streamlines your workflow, saving you valuable time that can be better spent on core business activities.

Case Study: Integrating Expense Tracking with QuickBooks at Zapier

Background: Zapier, a company known for its automation software, faced challenges with manual expense tracking and financial management. The company sought to improve efficiency and accuracy by integrating its expense tracking system with QuickBooks, a popular accounting software.

Implementation:

Integration: Zapier integrated Expensify, an expense management tool, with QuickBooks Online.

Automation: The integration automated the syncing of expense reports and transactions, reducing the need for manual data entry.

Results:

Time Savings: By automating the expense reporting process, Zapier saved approximately 40 hours per month on bookkeeping tasks.

Error Reduction: The automation reduced errors associated with manual data entry, leading to more accurate financial reporting.

Improved Insights: The integration provided real-time insights into company spending, helping the finance team make more informed decisions.

Conclusion: By integrating their expense tracking system with QuickBooks, Zapier significantly improved their financial management efficiency, saving time and reducing errors while gaining better visibility into their expenses.

Source:

This real-world example demonstrates the tangible benefits that companies can achieve by integrating their expense tracking tools with other financial systems.

Popular Financial Tools with Expense Tracking Integration

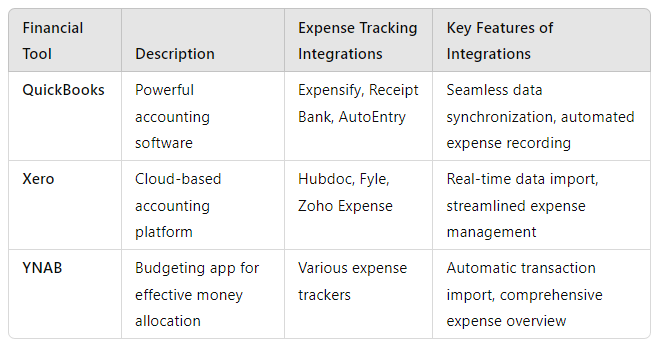

Many widely-used financial tools offer integration capabilities with expense tracking apps. Some notable examples include:

QuickBooks: This powerful accounting software integrates with various expense tracking tools, such as Expensify, Receipt Bank, and AutoEntry, allowing for seamless data synchronization.

Xero: Another popular cloud-based accounting platform, Xero offers integrations with expense management apps like Hubdoc, Fyle, and Zoho Expense.

YNAB (You Need A Budget): This budgeting app helps users allocate their money effectively and can be connected with expense trackers to automatically import transactions, providing a comprehensive view of expenses.

Popular Financial Tools with Expense Tracking Integration Compared

Comparison Table of Popular Financial Tools with Expense Tracking Integration

Setting Up and Managing Integrations for Seamless Financial Management

To ensure a smooth integration between your expense tracking tool and other financial software, follow these best practices:

Choose the right integration: Evaluate your specific needs and select an integration that aligns with your financial management goals and workflows.

Follow setup instructions carefully: Each integration will have its own setup process. Be sure to follow the provided instructions meticulously to avoid any configuration issues.

Test the integration: After setting up the integration, run a few test transactions to ensure data is flowing accurately between the systems.

Regularly review and reconcile: Periodically check the integration to confirm that transactions are being synced correctly and reconcile any discrepancies promptly.

Integration Troubleshooting Tips

If you encounter issues with your integration, try these troubleshooting steps:

Double-check your configuration settings to ensure they are correct

Reach out to the support teams of the respective tools for assistance

Consult online forums or communities for solutions to common integration problems

By leveraging the power of integrations, you can create a more efficient and effective financial management process that saves time, reduces errors, and provides valuable insights for your business.

Streamline Your Financial Journey

Tracking your income and expenses is a crucial aspect of managing your business finances effectively. By implementing the right tools and techniques, you can gain a clear picture of your financial health, make informed decisions, and ensure long-term success.

FreshBooks, QuickBooks Online, Ramp, and Zoho Expense are among the best expense tracking apps available, each offering unique features and benefits tailored to your specific needs. Whether you prioritize affordability, efficiency, automation, or mobile accessibility, there's an app that can help you streamline your financial management process.

By categorizing your expenses accurately and consistently, you can simplify financial planning, budgeting, and tax compliance. Take the time to create custom categories that reflect your unique business structure and industry, and maintain accurate records throughout the year.

Leveraging technology, such as automated card feeds and integrations with other financial tools, can further enhance your expense tracking experience. Embrace these advancements to save time, reduce errors, and gain valuable insights into your financial performance.

How will you revamp your expense tracking strategy to optimize your financial management and drive your business forward in 2024?