15 Fun Financial Literacy Activities for Kids in 2024

Teaching kids about money is crucial, but it doesn't have to be boring. In 2024, there are more fun and engaging financial literacy activities for kids than ever before. From classic board games to interactive online challenges, you can help your children develop essential money management skills while having a blast together.

I’m going to share 15 exciting ways to teach your kids about earning, saving, budgeting, and making smart financial decisions. Whether you're setting up a mock store at home or involving them in family financial planning, these hands-on experiences will set your children up for a lifetime of financial success.

Ready to make learning about money an adventure?

Let's dive in!

15 Money Management Games for Children to Learn Financial Literacy

Engaging board games and online activities teach kids valuable money management skills

Family game nights foster financial literacy and encourage open discussions about money

Interactive games make learning about earning, spending, and saving money fun for children

Board Games That Teach Kids About Money

Monopoly Junior, The Game of Life, and Payday are popular board games that introduce children to basic financial concepts in a fun and engaging way. These games simulate real-life financial situations, allowing kids to practice making decisions about earning, spending, and saving money.

Playing these games as a family encourages open discussions about money management and helps children understand the consequences of their financial choices. Family game nights not only promote financial literacy but also strengthen family bonds and create lasting memories.

Benefits of Playing Financial Board Games

Children learn to budget, invest, and manage resources

Games provide a safe environment to practice decision-making skills

Kids develop a better understanding of the value of money and the importance of saving

Online Financial Literacy Games for Kids

In addition to traditional board games, there are numerous online games designed to teach children money management skills. These interactive games, such as Peter Pig's Money Counter and Financial Football, engage children in learning through fun challenges and rewards.

Many of these games are free and easily accessible, making it convenient for parents to incorporate financial literacy activities into their children's screen time. The interactive nature of online games keeps children engaged and motivated to learn about money management.

Advantages of Online Financial Literacy Games

Age-appropriate content tailored to different learning levels

Accessible anytime, anywhere with an internet connection

Immediate feedback and rewards to reinforce learning

Engaging graphics and animations to hold children's attention

The Importance of Financial Literacy Games in 2024

Financial literacy games have become increasingly popular in recent years, with more parents recognizing the need to teach their children about money management from a young age. In 2024, the trend continues to grow as more innovative board games and online resources are developed to cater to different age groups and learning styles.

Over the past 12 months, there has been a surge in the creation of financial literacy apps and online platforms that gamify learning. These tools offer personalized learning paths, tracking progress and rewarding achievements. As technology advances, we can expect to see more immersive and interactive financial literacy games that leverage virtual and augmented reality.

Looking ahead, the next 12 months will likely bring more collaborations between educators, financial institutions, and game developers to create comprehensive financial literacy programs that combine classroom learning with engaging games. Parents can capitalize on these trends by actively seeking out new and effective resources to help their children build a strong foundation in money management skills.

Examples of Financial Literacy Games for Different Age Groups

For Younger Children (3-6): Cash Puzzler, Counting with Coins, and Making Change from the U.S. Mint teach basic money concepts and counting skills.

For Elementary School Children (5-10): Peter Pig's Money Counter and Wise Pockets provide interactive lessons on money management and budgeting.

For Preteens and Teenagers (11-18): Financial Football, Hit the Road: A Financial Adventure, and Payback offer more advanced lessons on personal finance and money management.

The Impact of Financial Literacy Games on Children's Money Management Skills

Studies have shown that financial literacy games can significantly improve children's understanding of money management. For example, a study by the National Financial Educators Council found that students who participated in financial literacy programs showed a significant increase in their financial knowledge and skills.

Fun Ways to Teach Kids About Saving and Budgeting

Engage children in saving and budgeting through interactive challenges and family activities

Develop responsible financial habits early on by setting achievable goals and tracking progress

Make learning about money management enjoyable with visual aids and age-appropriate tasks

Teaching financial literacy to kids can be a fun and rewarding experience when you approach it with creative and engaging activities. By involving children in saving challenges and family budgeting, you can help them develop essential money management skills that will serve them well throughout their lives. Here are some effective ways to make financial education enjoyable for kids:

Create a Savings Challenge for Your Kids

Setting up a savings challenge is an excellent way to encourage children to develop a habit of saving money regularly. Start by helping your child set a specific savings goal, such as saving for a new toy or a special outing. Encourage them to save a certain amount each week or month, depending on their age and allowance.

Set Achievable Goals

When setting savings goals, it's important to ensure they are realistic and achievable for your child's age and income. For younger children, a goal of saving $5 to $10 per week might be appropriate, while older children can aim for higher amounts. Break down the goal into smaller milestones to keep them motivated and celebrate their progress along the way.

Use Visual Aids

Make saving more engaging by using visual aids like sticker charts or coloring pages. Create a chart where your child can add a sticker or color in a section each time they save a certain amount. This visual representation of their progress can be highly motivating and help them stay on track.

Implement a Family Budgeting System

Involving children in the family budgeting process is an excellent way to teach them about responsible spending and the value of money. Start by explaining the concept of budgeting and how it helps the family manage expenses and save for future goals.

Assign Age-Appropriate Tasks

Depending on your child's age, assign them tasks that contribute to the family budget. For example, younger children can help create a grocery list based on the family's needs and budget, while older children can compare prices between different brands or stores to find the best deals. This involvement helps them understand the decision-making process behind spending and saving.

Discuss the Benefits

Regularly discuss the benefits of involving children in the family budget. Highlight how their contributions help the family save money and reach financial goals. By participating in budgeting discussions and tasks, children develop a sense of responsibility and gain valuable insights into managing money effectively.

By implementing these fun and engaging activities, you can teach your children the importance of saving and budgeting in a way that is both educational and enjoyable. As they grow older, these early lessons in financial literacy will help them make informed decisions about their money and develop responsible financial habits that last a lifetime.

Engaging Financial Education Activities for Elementary Students

TL;DR:

Teach kids about pricing, profit, and customer service through mock stores or lemonade stands

Involve children in planning and executing a family yard sale to learn about the value of possessions, pricing, and negotiation skills

Financial literacy is the ability to understand and effectively use various financial skills, such as budgeting, saving, and investing. Teaching children these essential skills from an early age can help them develop a strong foundation for managing their finances responsibly in the future.

Set Up a Mock Store or Lemonade Stand

Setting up a pretend store or lemonade stand is an excellent way to teach children about pricing, profit, and customer service. By engaging in this roleplay activity, kids can learn how to price their products, calculate profits, and interact with customers in a fun and educational environment.

Step-by-Step Guide to Create a Mock Store or Lemonade Stand at Home

Choose a location: Find a suitable space in your home or backyard to set up the mock store or lemonade stand.

Gather materials: Help your child collect items such as cardboard boxes, paper, markers, and toy money to create their store or stand.

Create products: Assist your child in making or selecting products to sell, such as handmade crafts, baked goods, or lemonade.

Set prices: Discuss with your child how to determine prices for their products, considering factors like the cost of materials and desired profit.

Design signage: Encourage your child to create attractive signs and price tags for their store or stand.

Role-play: Have family members or friends act as customers, allowing your child to practice customer service skills and handle play money transactions.

Roleplay is crucial in helping children understand real-world financial situations. By engaging in these simulated experiences, kids can develop problem-solving skills, learn to communicate effectively, and gain confidence in handling money-related interactions.

Organize a Family Yard Sale

Involving children in planning and executing a family yard sale is another excellent way to teach them about the value of possessions, pricing, and negotiation skills. This hands-on activity allows kids to actively participate in the decision-making process and learn valuable lessons about money management.

Tips to Make the Yard Sale a Fun and Educational Experience

Involve children in the planning process: Ask your kids to help select items to sell, organize them into categories, and determine prices.

Teach pricing strategies: Explain to your children how to price items based on their condition, age, and market value. Encourage them to research similar items online to make informed decisions.

Practice negotiation skills: Role-play with your children to help them learn how to negotiate prices with customers politely and confidently.

Assign responsibilities: Give your kids specific tasks during the yard sale, such as greeting customers, answering questions, or handling transactions.

Discuss the importance of saving and budgeting: After the yard sale, talk to your children about how they can allocate the money they earned, emphasizing the importance of saving for future goals and budgeting for expenses.

By involving children in the entire process of a family yard sale, they can gain a deeper understanding of the value of money, the importance of responsible spending, and the benefits of saving for the future.

Teaching Kids About Budgeting Through Real-Life Scenarios

Provide children with hands-on experience in managing money through allowances and family financial decisions

Help kids develop critical thinking and problem-solving skills related to budgeting and spending

Encourage open communication about money matters to foster financial literacy from a young age

Give Children an Allowance and Teach Them to Manage It

Providing children with an allowance is an excellent way to teach them about budgeting and managing money responsibly. By giving them a fixed amount of money to work with, they learn to prioritize their spending and make informed decisions about their purchases.

To determine an appropriate allowance amount, consider factors such as your child's age, maturity level, and the responsibilities they are expected to fulfill. For example, a 7-year-old might receive a smaller allowance than a 12-year-old who has more expenses and is expected to contribute to household chores.

Creating a Simple Budget

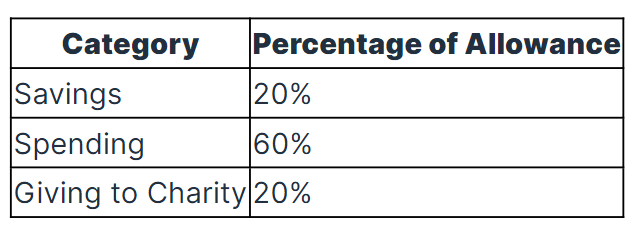

Once you've established an allowance, help your child create a simple budget to track their income and expenses. This can be done using a spreadsheet, a budgeting app, or even a pen and paper. Encourage them to allocate a portion of their allowance to different categories, such as savings, spending, and giving to charity.

Categories for Allowance Allocation

By regularly reviewing their budget with them, you can help your child understand the importance of living within their means and making adjustments when necessary. This hands-on experience will lay the foundation for sound financial decision-making in the future.

Involve Kids in Family Financial Decisions

Involving children in age-appropriate family financial decisions is another effective way to teach them about budgeting and money management. By including them in discussions about planning a vacation, choosing a cell phone plan, or making a major purchase, you help them understand the decision-making process and the factors that influence these choices.

When involving kids in these discussions, be sure to explain the pros and cons of each option and how they fit into the overall family budget. Encourage them to ask questions and share their opinions, as this helps develop their critical thinking and problem-solving skills.

Real-Life Examples

For instance, when planning a family vacation, discuss the different travel options, such as driving versus flying, and how each choice impacts the budget. Show them how to research prices for accommodations, activities, and meals, and work together to create a realistic travel budget.

Similarly, when choosing a cell phone plan, discuss the various options available and how they align with the family's needs and budget. Help them understand the costs associated with data usage, texting, and other features, and guide them in making an informed decision.

By involving kids in these real-life financial scenarios, you not only teach them valuable budgeting skills but also foster open communication about money matters. This transparency helps create a positive relationship with money and sets the stage for continued financial literacy education.

Encourage Goal-Setting and Saving

Teaching children to set financial goals and save towards them is another crucial aspect of budgeting. Encourage your kids to identify short-term and long-term goals, such as saving for a new toy, a summer camp, or even a college education.

Help them break down these goals into smaller, manageable steps and create a plan to reach them. For example, if your child wants to save $50 for a new video game, help them calculate how much they need to save each week from their allowance to reach that goal within a specific timeframe.

Visual Aids and Tracking Progress

To make the process more engaging, consider using visual aids like a goal chart or a savings jar. This allows children to track their progress and see the tangible results of their efforts. Celebrate milestones along the way to keep them motivated and reinforce the importance of saving.

By encouraging goal-setting and saving, you help your children develop a future-oriented mindset and understand the value of delayed gratification. These skills will serve them well as they navigate more complex financial decisions later in life.

Discuss the Difference Between Needs and Wants

Another essential aspect of budgeting is understanding the difference between needs and wants. Help your children grasp this concept by discussing how needs are essential items, such as food, shelter, and clothing, while wants are desires that can be fulfilled if there's room in the budget.

Encourage your kids to prioritize their needs before allocating money to their wants. This can be done through real-life examples, such as choosing to purchase a needed school supply before buying a new toy.

Opportunity Cost

Introduce the concept of opportunity cost, which is the value of what must be given up to acquire something else. For example, if your child spends their entire allowance on a new video game, they may have to forgo a trip to the movies with friends.

By discussing the trade-offs involved in financial decisions, you help your children develop critical thinking skills and learn to make informed choices that align with their goals and values.

Teach the Importance of Giving Back

Finally, budgeting isn't just about managing personal finances; it's also about understanding the importance of giving back to the community. Encourage your children to allocate a portion of their allowance or savings to charitable causes they care about.

Discuss the various ways they can give back, such as donating money, volunteering their time, or participating in fundraising events. Help them research local charities or causes that align with their interests and values, and guide them in making a plan to contribute regularly.

By teaching the importance of giving back, you help your children develop empathy, social responsibility, and a sense of purpose. They learn that their financial decisions can have a positive impact on the world around them, fostering a more holistic approach to money management.

According to a study, 71% of children who engage in charitable giving at a young age are more likely to continue this habit as adults.

Free Financial Literacy Courses and Resources for Kids

Online courses, webinars, podcasts, and YouTube channels provide engaging ways for children to learn about money management

Books and magazines offer age-appropriate content that helps kids understand and retain financial concepts

These resources are often free or easily accessible, making financial education more accessible for families

Online Courses and Webinars

Free online financial literacy courses and webinars designed for children are an excellent way to provide a structured learning experience. Platforms like Khan Academy and the Federal Reserve offer comprehensive programs that cover a wide range of financial topics, from basic budgeting to investing.

These courses are often self-paced, allowing children to learn at their own speed and revisit concepts as needed. They also provide interactive elements, such as quizzes and games, to keep kids engaged and reinforce their understanding of key ideas.

Khan Academy's "Finance and capital markets" course

The Federal Reserve's "Money Smart for Young People" program

Benefits of Online Courses and Webinars

Online courses and webinars offer several benefits for children learning about financial literacy:

Flexibility: Kids can access the content whenever and wherever they have an internet connection, making it easier to fit learning into busy schedules.

Interactivity: Many courses include engaging elements like quizzes, games, and videos to keep children interested and help them retain information.

Comprehensive content: Well-designed courses cover a broad range of financial topics, ensuring that children receive a thorough education in money management.

Podcasts and YouTube Channels

Podcasts and YouTube channels are another engaging way for children to learn about financial literacy. These formats often present information in a fun, relatable manner, using stories, examples, and humor to make complex concepts more accessible.

Popular child-friendly financial literacy podcasts include Million Bazillion, which explores money-related topics through conversations with experts and real kids, and Money Prodigy, which teaches financial concepts through storytelling and interactive elements.

Million Bazillion podcast

Money Prodigy podcast

BizKid$ YouTube channel

Benefits of Podcasts and YouTube Channels

Podcasts and YouTube channels offer unique advantages for children learning about financial literacy:

Entertainment value: These formats often present information in an entertaining way, using humor, storytelling, and engaging visuals to capture children's attention.

Accessibility: Podcasts and YouTube videos can be accessed on various devices, making it easy for kids to learn on the go or during downtime.

Relatable content: Many podcasts and YouTube channels feature real kids and their experiences with money, helping children connect with the content on a personal level.

Books and Magazines

Age-appropriate books and magazines are a tried-and-true method for teaching children about financial literacy. These resources present complex concepts in a way that is easy for kids to understand, often using illustrations, stories, and examples to convey key ideas.

Popular financial literacy books for children include "The Berenstain Bears' Dollars and Sense," which teaches basic money management skills through the beloved bear family's experiences, and "How to Turn $100 into $1,000,000," which introduces entrepreneurship and investing concepts for kids.

"The Berenstain Bears' Dollars and Sense" by Stan and Jan Berenstain

"How to Turn $100 into $1,000,000" by James McKenna and Jeannine Glista

Benefits of Books and Magazines

Books and magazines offer several benefits for children learning about financial literacy:

Tangible resources: Physical books and magazines provide a tangible learning experience that can be revisited and shared with others.

Comprehensive content: Well-written books and magazines cover a wide range of financial topics, providing children with a thorough understanding of money management concepts.

Engaging formats: Many financial literacy books and magazines use illustrations, stories, and interactive elements to make learning about money fun and engaging for kids.

Empowering Kids with Money Management Skills

Teaching children about money management early on sets them up for a lifetime of financial success. From engaging board games to interactive online tools, there are numerous fun activities that help kids grasp the basics of earning, saving, and spending wisely.

Involving children in family budgeting and real-life financial decisions not only teaches them valuable skills but also fosters a sense of responsibility and independence. By providing age-appropriate allowances and guiding them through the process of managing their own money, you empower your kids to make informed financial choices.

What steps will you take to incorporate financial literacy into your child's life?

Consider starting with a simple savings challenge or exploring the wealth of free online courses and resources available. By making money management education a fun and engaging part of your family's routine, you'll be setting your children on the path to a financially secure future.